The Facts About Home Improvement News Uncovered

Wiki Article

Examine This Report on Home Improvement News

Table of ContentsRumored Buzz on Home Improvement NewsThe 2-Minute Rule for Home Improvement NewsThe 6-Minute Rule for Home Improvement NewsThe Basic Principles Of Home Improvement News

So, by making your home more safe and secure, you can in fact make a revenue. The interior of your home can get outdated if you don't make changes and upgrade it every as soon as in a while. Interior decoration styles are always transforming as well as what was fashionable five years back might look outrageous right now.You could even feel burnt out after considering the very same setting for many years, so some low-budget changes are constantly welcome to offer you a little adjustment. You select to include some timeless components that will proceed to seem existing and fashionable throughout time. Don't stress that these restorations will certainly be costly.

Pro, Tip Takeaway: If you feel that your residence is too little, you can redesign your basement to increase the amount of room. You can use this as an extra room for your household or you can lease it out to create extra revenue. You can maximize it by employing experts that provide redesigning solutions.

All about Home Improvement News

Residence restorations can boost the means your house looks, however the advantages are a lot more than that. Review on to discover the advantages of home remodellings.

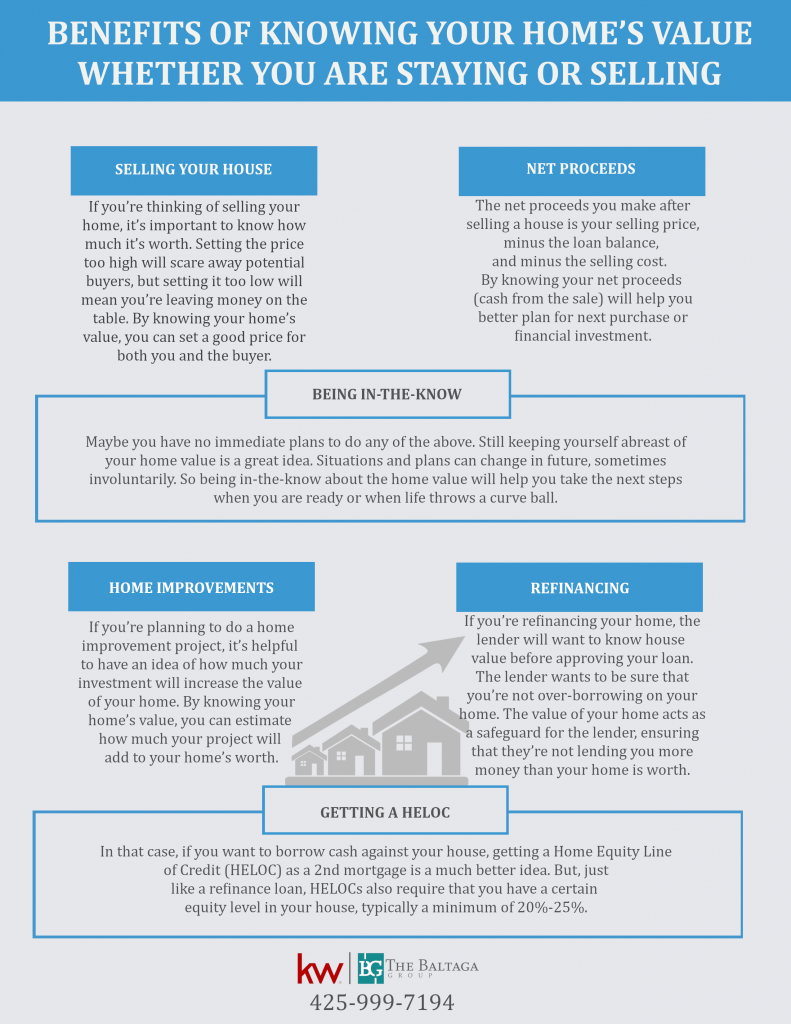

Not only will it look out-of-date, but locations of your home as well as important systems can start to show wear. Regular residence repair and maintenance are needed to preserve your property worth. A house restoration can assist you maintain and also boost that value. Projects like outside improvements, kitchen area restorations, as well as shower room remodels all have exceptional returns on financial investment.

House equity financings are preferred amongst home owners aiming to money improvements at a reduced rate of interest price than other financing options. The most typical usages for house equity. https://qfreeaccountssjc1.az1.qualtrics.com/jfe/form/SV_0BdjHJV7fHPGAVE financing are residence improvement tasks and financial debt combination. Using a residence equity funding to make residence renovations features a couple of benefits that uses do not.

Home Improvement News for Beginners

That set rate of interest means your regular monthly settlement will correspond over the regard to your finance. In a rising rates of interest environment, it may be simpler to factor a set settlement into your budget plan. The various other choice when it comes to touching your residence's equity is a home equity line of credit score, or HELOC.Both residence equity finances as well as HELOCs use your residence as security to protect the lending. If you can't manage your monthly repayments, you could shed your house-- this is the most significant threat when obtaining with either kind of funding.

Consider not simply what you want today, however what will certainly interest future purchasers because the jobs you pick will impact the resale worth of your house. Job with an accountant to make certain your passion is correctly subtracted from your taxes, as it can save you 10s of hundreds of bucks over the life of the finance (landscaping ideas).

Some Known Details About Home Improvement News

Residence equity car loans have reduced rates of interest compared to other types of finances such as personal finances and charge card. Present home equity prices are as high as 8. 00%, however individual financings are at 10. 81%, according to CNET's sis website Bankrate. With a home equity lending, your rate of interest will be taken care of, so you don't have to bother with it increasing in a rising rates of interest setting, such as the one we remain in today.Also as pointed out over, it matters what type of renovation tasks you undertake, as particular house improvements offer a greater return on financial investment than others. A small kitchen area remodel will redeem 86% of its worth when you sell a house contrasted with 52% for you can look here a timber deck enhancement, according to 2023 information from Redesigning publication that assesses the price of redesigning projects.

While home worths have actually skyrocketed over the last 2 years, if home costs go down for any type of reason in your area, your financial investment in improvements will not have actually raised your home's value. When you wind up owing extra on your home loan than what your residence is actually worth, it's called unfavorable equity or being "undersea" on your home loan.

A HELOC is often much better when you desire more versatility with your car loan. With a fixed-interest price you don't require to bother with your settlements increasing or paying a lot more in passion over time. Your monthly repayment will always be the very same, no matter what's taking place in the economy. Every one of the money from the lending is dispersed to you upfront in one repayment, so you have access to every one of your funds instantly.

Report this wiki page